RRSP VS TFSA

With the addition of the TFSA it has opened up all sorts of tax planning options for retirement. Gone are the days where you must blindly maximise your RRSP’s every year as they have both pros and cons. The traditional RRSP provides a tax deduction at your marginal tax bracket and the proceeds grow tax deferred but they are also taxed upon withdrawal. The TFSA on the other hand does not provide a tax deduction but the proceeds grow tax free and can be pulled out tax free. So which account is best for your long-term retirement planning?

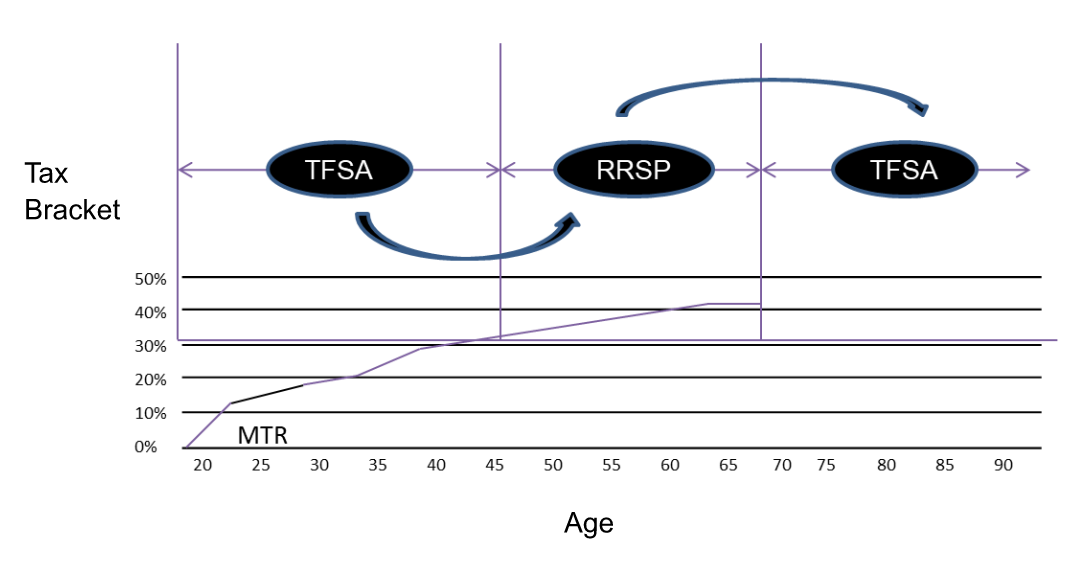

It really depends on your tax situation as the chart below illustrates. The key to remember in this is the RRSP is investing pre-tax dollars which gives the account a huge head start. In this case if your tax deduction provided today on the RRSP is equal to the tax rate in pulling out the money in retirement it is dead even. However if your tax rate is projected to be lower in retirement it favors the RRSP and the TFSA comes out on top if the tax rate is higher in retiremet. Your tax rate is dictated by how much taxable income you generate, the more income the higher percentage of tax.

| TFSA | RRSP | |

|---|---|---|

| Pre-Tax Income | $1,000 | $1,000 |

| Tax (40%) | ($400) | NA |

| Net Contribution | $600 | $1,000 |

| Growth at 6% for 20 years | $1,924.28 | $3,207.14 |

| Tax Upon Withdrawal | NA | ($1,282.85) |

| Net Cash | $1,924.28 | $1,924.28 |

Digging Deeper

What makes this more complicated is how do you know what your taxes in retirement will be? Most of us will not know with certainty but you can project this using a financial plan. It can be scary what you can uncover, for example if you are in a 36% tax bracket in Alberta and over the age of 65 you are also most likely being clawed back on your OAS. This moves your effective rate of tax to 51%, so if this is your situation RRSP’s may not be the best option.

For most of us though financial plans are changing yearly and it hard to know with certainty what your future tax bracket will be. As much as I hate rules of thumb the chart below can help. Here it shows that as you enter roughly a 30.5% tax bracket (In AB over $53,359) this can make the RRSP deduction of greater value. This type of income is also usually earned as you get older. It is worth noting that TFSA’s can also be rolled into an RRSP later on when you are in a higher tax bracket. It also shows that at age 72 you may no longer be able to invest in an RRSP.

Additional Keys

What about the refund? - Many of us actually contribute to an RRSP with after tax dollars which may generate a tax refund. This differs from having 100% of your money invested and raises the question of what you did with the refund. If not invested it changes these outcomes.

Benefits of Deferring Tax - You may also want to consider the benefit of deferring tax which an RRSP can do. With this the tax in retirement may not be as critical but you may change your mind when you start paying it while taking into account the effect on your senior benefits.

Estate Taxes - It is also worth noting that TFSA’s pay out tax free to beneficiaries where as RRSP’s can be 100% taxable income in the year of death (Also see our article on the Art of the RRSP/ RRIF drawdown). If you have a spouse, you can defer the tax but when the second spouse passes it is all due. If there is a lot of money left in these plans, it can greatly erode estate value.

The TFSA is not just a savings account - Despite what the name suggests you can invest in a variety of assets in the TFSA and not just low interest savings. Many financial institutions have not helped this by slapping investors in a promotional savings account when they open a plan. In fact TFSA’s are ideal for growth assets like stocks as it is the growth that is tax free.

TFSA Flexibility -

This plan can also be used for short term needs and not just retirement which is nice. This provides a lot of flexibility but it can potentially hurt a plan by an investor accessing the funds early for spending.

Conclusions

As with most financial planning there is not one answer for everyone and requires examining your specific situation. What I would say though is that in most plans a combination of some sort can be the most effective. While RRSP’s provide tax savings today the TFSA can supply easy access to tax free income in retirement without triggering clawbacks of your senior benefits. I recommend ensuring you have a financial plan in place to make a good choice for your case.

WEB:

bellvest.ca/family-wealth-calgary

E-MAIL: dan.beyaert@bellvest.ca

Phone: 403-508-1516

Fax:

403-231-8631